With the ever-changing world of cybersecurity, it’s more important than ever for businesses to manage potential risks and keep their data safe. While the advancement in technology has made our lives easier, it has also caused a major rise in cyber threats. Fortunately, there is a useful solution to protect companies from these kinds of risks: cyber insurance. This comprehensive cyber insurance guide is intended to provide insights into what cyber insurance is and how businesses can implement this powerful tool. Read on as we explain everything you need to know about cyber insurance.

What is Cyber Insurance and Why Your Business Needs It

In today’s world, businesses face countless cyber threats that can lead to devastating financial and reputational consequences. Cyber insurance, also known as cyber liability insurance, is a crucial component in protecting your business from these threats.

This type of insurance helps protect your organization from cyber attacks like hacking, data breaches, and other security incidents. It can also provide access to experts who can help you navigate the situation.

From swiftly responding to breaches, to managing public relations and assisting with regulatory compliance, investing in cyber insurance is an essential step in protecting your business from the ever-evolving landscape of cyber risks.

Overview of Different Types of Cyber Insurance Policies

In order to protect businesses from potential financial losses due to cyber incidents, a range of cyber insurance policies have been developed. These policies, which can vary greatly in terms of coverage and cost, can be customized to suit the needs of every company.

For instance, some policies may offer protection from data breaches. This means it covers the cost of responding to the breach, getting legal assistance, and managing any bad publicity.

On the other hand, some policies help protect against ransomware attacks. These policies may cover the costs to investigate, negotiate with the attackers, and even pay the ransom if needed.

By understanding the different policy options, businesses can better evaluate their risks and make more informed decisions regarding the best way to protect themselves.

Preparing for a Cyber Insurance Audit

Preparing for a cyber insurance audit might seem like a daunting task, but with the right mindset and approach, it can actually be a smooth and beneficial process.

First and foremost, you should treat this audit as an opportunity to review and strengthen your company’s risk management strategies. Gathering information such as cybersecurity policies, incident response plans, and records of any previous cyber incidents is important.

Next, take the time to review and update these documents if needed. Doing so will show the auditor that you’ve got everything under control as well as uncover any issues in your current measures. Moreover, communication is key – involve your team and make sure everyone is aware of the upcoming audit and their roles in making it a success.

Lastly, remember that auditors are there to help. So, don’t hesitate to ask questions or seek guidance throughout the process.

Overall, staying proactive and prepared will help make your next cyber insurance audit a breeze.

Understanding the Different Types of Coverages

Trying to make sense of cyber insurance coverage can be a bit overwhelming. With that said, we’ll break it down to help give you a better understanding of how it works.

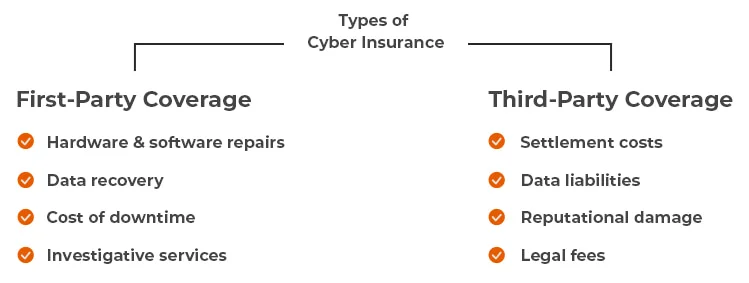

Essentially, cyber insurance is designed to protect businesses from financial losses caused by cyber-attacks. The coverage may include both first-party and third-party aspects.

First-Party Coverage

First-party coverage handles the damages that you and your business suffer as a result of a breach. This typically includes:

- Hardware and software repairs

- Data recovery

- The cost of business downtime

- Investigative services

Third-Party Coverage

Meanwhile, third-party coverage comes into play when your customers or partners are affected by the breach. Generally speaking, third-party coverage includes:

- Settlement costs

- Customer data liabilities

- Damages to reputation

- Legal fees

By educating yourself on these components of cyber insurance, you can better prepare your business with the necessary tools to minimize potential risks.

How to Choose the Right Cyber Insurance Policy for Your Business

In today’s digital age, it’s important for businesses to prioritize the security of their systems and information. Choosing the right cyber insurance policy is a big decision, but with a relaxed and thoughtful approach, you can find the best fit for your company’s needs.

Start by identifying specific risks that your business may encounter. Many of which may include data breaches, system downtime, or malware attacks.

Then, do some research and gather information on the types of policies and coverage options available in the market. Don’t shy away from asking questions and seeking expert advice! Comparing policies and understanding the differences in coverage, premiums, and service requirements will help in your decision-making process.

Lastly, keep in mind that no policy will provide total protection. So, be proactive and invest in security measures that complement your insurance and enhance your overall security posture.

Common Misconceptions About Cyber Insurance

When discussing cyber insurance, several misconceptions often bubble to the surface in casual conversation. For example, a popular myth is that it only provides coverage for large enterprises. However, businesses of all sizes can benefit from cyber insurance.

Another assumption is that cyber insurance is far too expensive. But just like other types of insurance, it can actually save you a lot of money in the long run.

Some people also believe that using a firewall and antivirus software alone will provide enough protection. As much as we would like this to be true, it isn’t. Cybercriminals are very creative and even with the best products and software, there is always a risk. So, what can you do to minimize that risk? Well, you get the point.

As you can see, it’s important that we disregard these misconceptions and start understanding how useful cyber insurance can be.

Let’s Wrap This Up

Cyber insurance is a must-have for businesses of all sizes. It provides an extra layer of protection against cyber criminals who are always looking for new targets. Becoming a victim of their attacks can drastically hurt a company’s finances, reputation, and operations.

There are many types of cyber insurance policies and each can be customized to meet your needs. By having a clear understanding of those needs and what each policy offers, you’re well on your way to finding the right coverage for your business.

Additionally, it is important to properly prepare for a cyber insurance audit. This means ensuring that all policies are up-to-date and reviewing all certifications if applicable to your plan.

Finally, forget any misconceptions about cyber insurance. The reason we all have home and auto insurance is for those “what-if” moments. So, what would happen if you lost your customers’ most sensitive data after an attack?

Questions?

If you have any questions regarding cyber insurance, we would love to hear from you. Our cybersecurity experts have been helping secure businesses for decades and are always ready for a new challenge.